Ontario leads Canada for rising rates of people not paying credit card bills

Canadians have been feeling the economic noose tightening around their necks for a few years now, with the cost of living — especially in cities like Toronto and Vancouver — skyrocketing above even our usually-exorbitant levels over the course of COVID and remaining ridiculously high ever since.

Those living in the GTA are, in many respects, faring the worst, forced to spend more of their earnings on housing than people in nearly any other metropolis in not just Canada, but the world, according to a new report from the esteemed Oxford Economics.

It naturally follows, then, that the city and province of Ontario as a whole have been seeing a startling uptick in people failing to pay off their mortgages and other bills.

While the Toronto area now boasts the fastest-rising rate of 90-day mortgage delinquencies in Canada, new data shows that Ontario is experiencing the largest surge in residents defaulting on their credit card, car loans and other non-housing bills of any province.

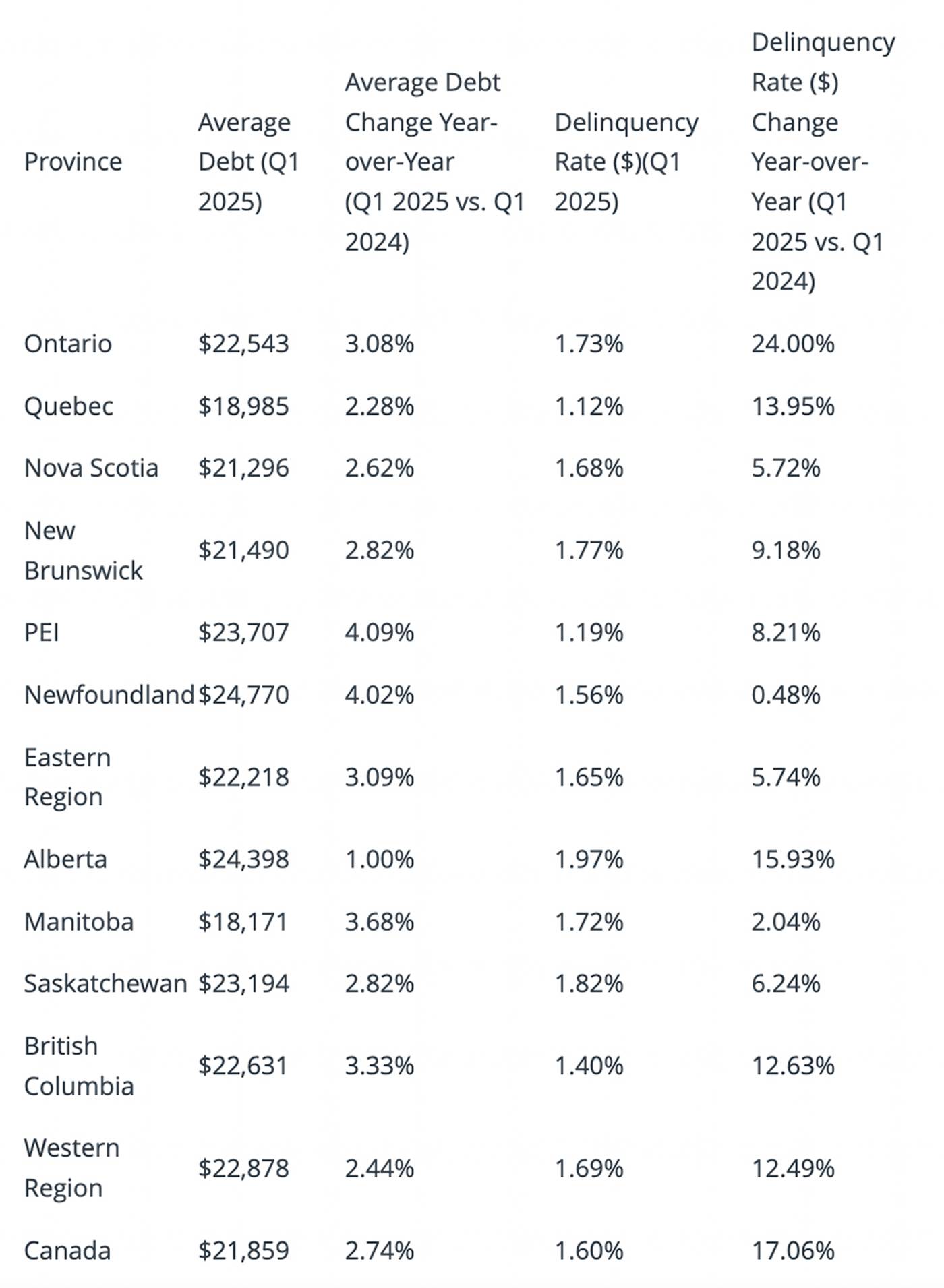

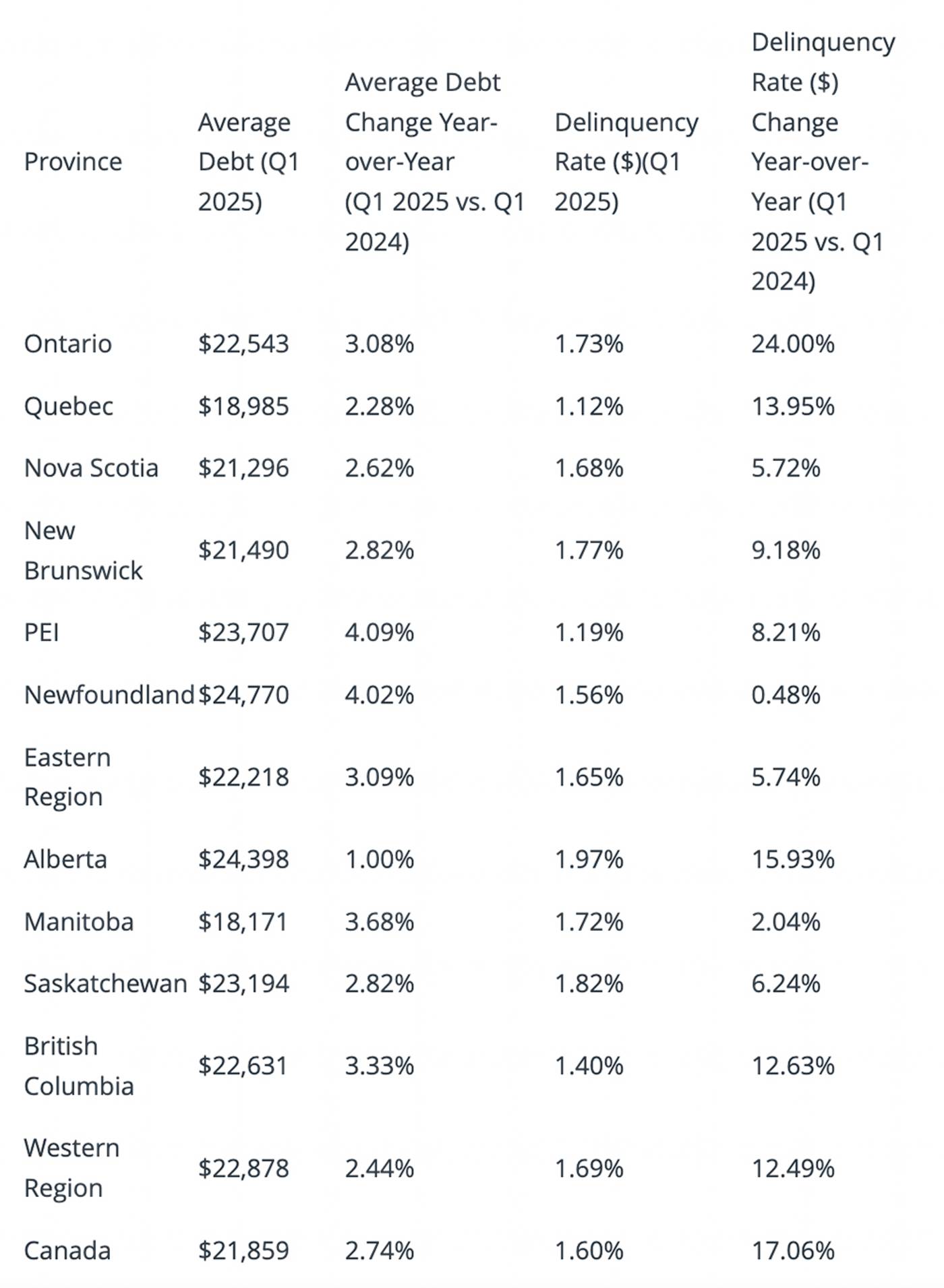

An analysis of national debt (outside of mortgages) just released by Equifax shows that Canada hasn't had a debt delinquency issue this bad since 2009, with the first few months of 2025 marking a 17.06 per cent year-over-year increase in customers paying their bills late or not at all.

Ontario is the worst culprit, and it's been a repeating pattern.

Ontario sees another enormous jump in people not paying housing and other bills https://t.co/MZtYPoFMBl

— blogTO (@blogTO) February 27, 2025

The province saw a shocking 24 per cent more people defaulting on non-mortgage bills during the first quarter of 2025 (versus the same time last year), the largest jump in the country. Alberta came in second for annual growth in credit and other debt, at 15.93 per cent. Following that was Quebec (13.95 per cent), then B.C. (12.63 per cent) and the Western Region (12.49 per cent).

Newfoundland only saw 0.48 per cent more people not making these payments on time (or ever), while Manitoba's figure was just 2.04 per cent.

Looking at the city level, Toronto's year-over-year change in delinquency rate was highest in Canada at a bonkers 24.28 per cent, compared to somewhere like St. John's, where it was 1.19 per cent.

As far as actual delinquency rate, versus change from one year to the next, Fort McMurray won out with 2.56 per cent of people failing to repay their debts, followed by Edmonton (2.26 per cent) and then Toronto (2.17 per cent).

Alberta has the most damning delinquency rate of any province at 1.97 per cent, followed by Saskatchewan (1.82 per cent), New Brunswick (1.77 per cent), then Ontario (1.72 per cent).

Equifax

Fort Mac also has the highest average non-mortgage consumer debt in dollar amount of the cities examined, at $37,269 (Toronto came in seventh out of nine locales, with an average of $21,048). Provincially, Newfoundland dwellers have the largest actual debt, at an average of $24,770 (Ontario came in seventh out of 13, with the average personal non-mortgage debt at $22,543).

With a recession on the horizon, these numbers could likely climb higher, even if inflation rates ease.

JHVE/Shutterstock.com

Latest Videos

Latest Videos

Join the conversation Load comments