Ontario expected to fall into recession this year as a result of U.S. tariffs

There's been a lot of talk about a forthcoming recession in Canada since Wells Fargo forecasted that the nation will "enter a technical recession this year," but anyone who's been staying abreast of our languishing economic trajectory is well aware that we've already been in a per-capita recession for many months.

With unemployment continuing to rise alongside the cost of living, the U.S. slapping tariffs on Canadian imports has come at possibly the worst time, and will be a key factor edging us into recession proper.

Of course, some industries and geographical areas will feel the effects more than others, depending on how things end up playing out in the hands of a flip-floppy President Trump. But when it comes to Ontario specifically, one new report sheds light on what Canada's most populous province can expect economically.

Coming from the desk of the Financial Accountability Office of Ontario, the document, released on Wednesday, says that the levies from the south are likely to deteriorate demands for Ontario goods and services, slowing GDP growth to about 0.6 per cent, in contrast to what would have been 1.7 per cent sans tariffs.

This will, the body says, lead to a "modest recession" sometime this year, with an unemployment rate substantially higher than it is already.

Things will rebound a bit by 2026, with a higher 1.2 per cent rate of GDP growth expected — again, lower than 1.9 per cent without tariffs, but still an improvement over what's expected in the months to come — but, when looking at real GDP rather than GDP growth, the picture does look a little bleak.

"Overall, under the FAO's tariff scenario, the level of Ontario's real GDP is projected to be 1.8 per cent lower than the no tariff scenario by 2026, and 2.0 per cent lower by 2029 as the heavy declines in Ontario's steel, aluminum, auto and auto parts sectors are only partially offset by modest trade gains in other sectors," the report states.

It adds that the province's economy is expected to adjust somewhat to the impacts of U.S. tariffs, with real GDP growth — not real GDP in dollars, as referenced to above —will "improve to an average of 1.8 per cent over the 2027 to 2029 period, modestly slower than the no tariff scenario of 1.9 per cent."

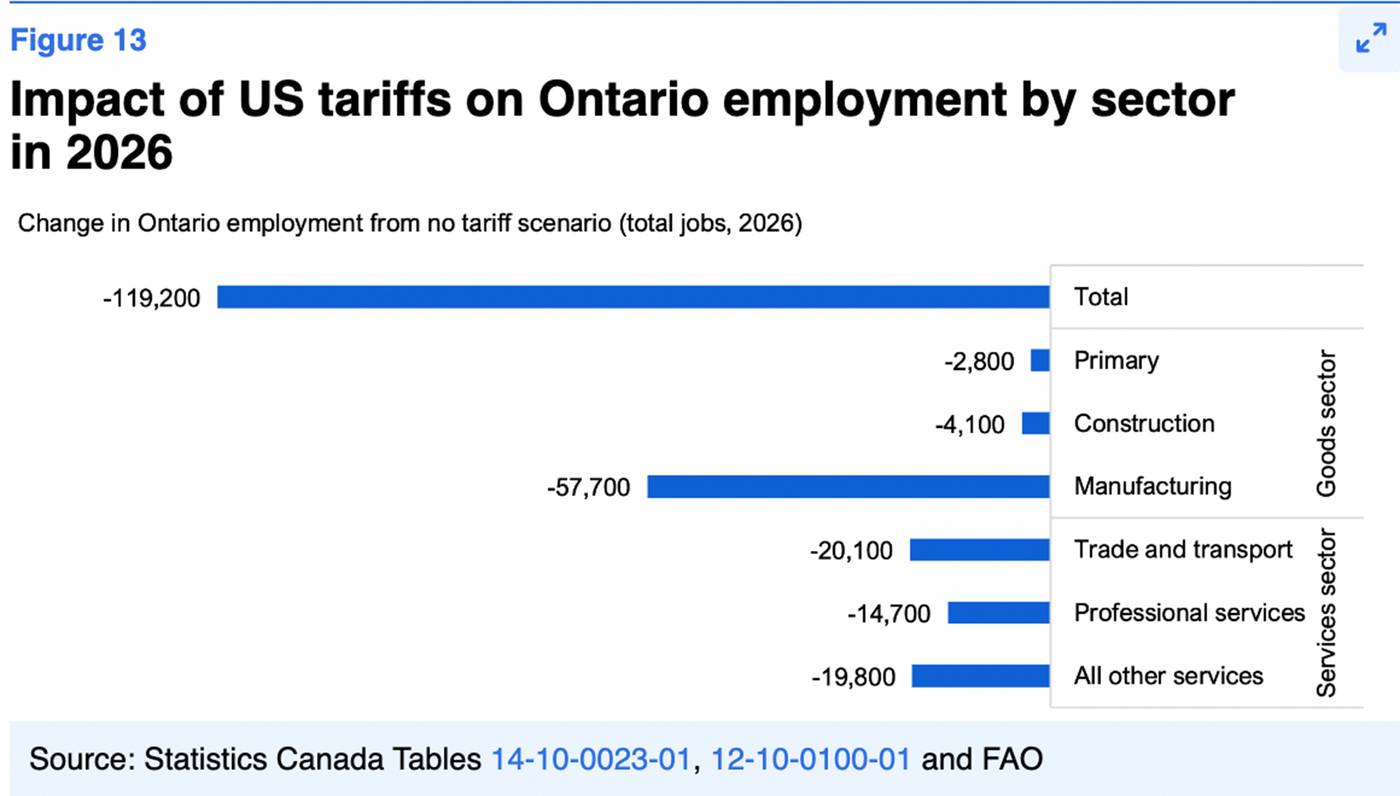

Leading this all is the hit to the manufacturing sector (-8 per cent real GDP expected after a full year of tariffs), especially auto manufacturing (-22.3 per cent) though the study notes that "all other sectors, including services, will also be impacted through supply chain effects [and] broader economic impacts."

These "broader" impacts include lower profits, consumption, investment and incomes in general, as, naturally, the number of available jobs also falls off a cliff.

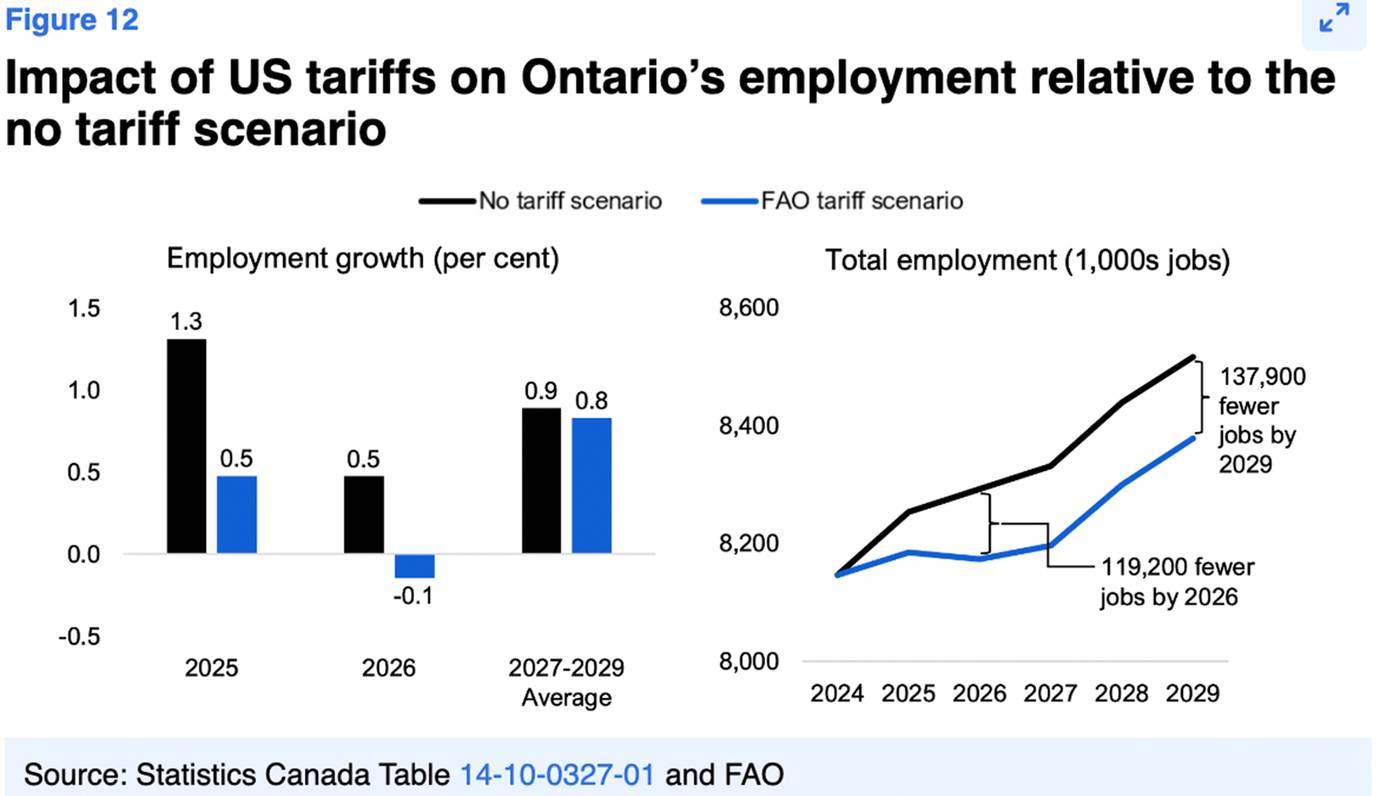

The FAO expects employment growth to plummet to 0.5 per cent this year, a far cry from the still-not-phenomenal 1.3 per cent in a no-tariff world, and then fall another 0.1 per cent still in 2026.

"Weaker job growth would result in 68,100 fewer jobs in Ontario in 2025, compared to the no-tariff scenario, and 119,200 fewer jobs in 2026. By 2029, under the FAO tariff scenario, there would be 137,900 fewer jobs in Ontario compared to the no tariff scenario," it states.

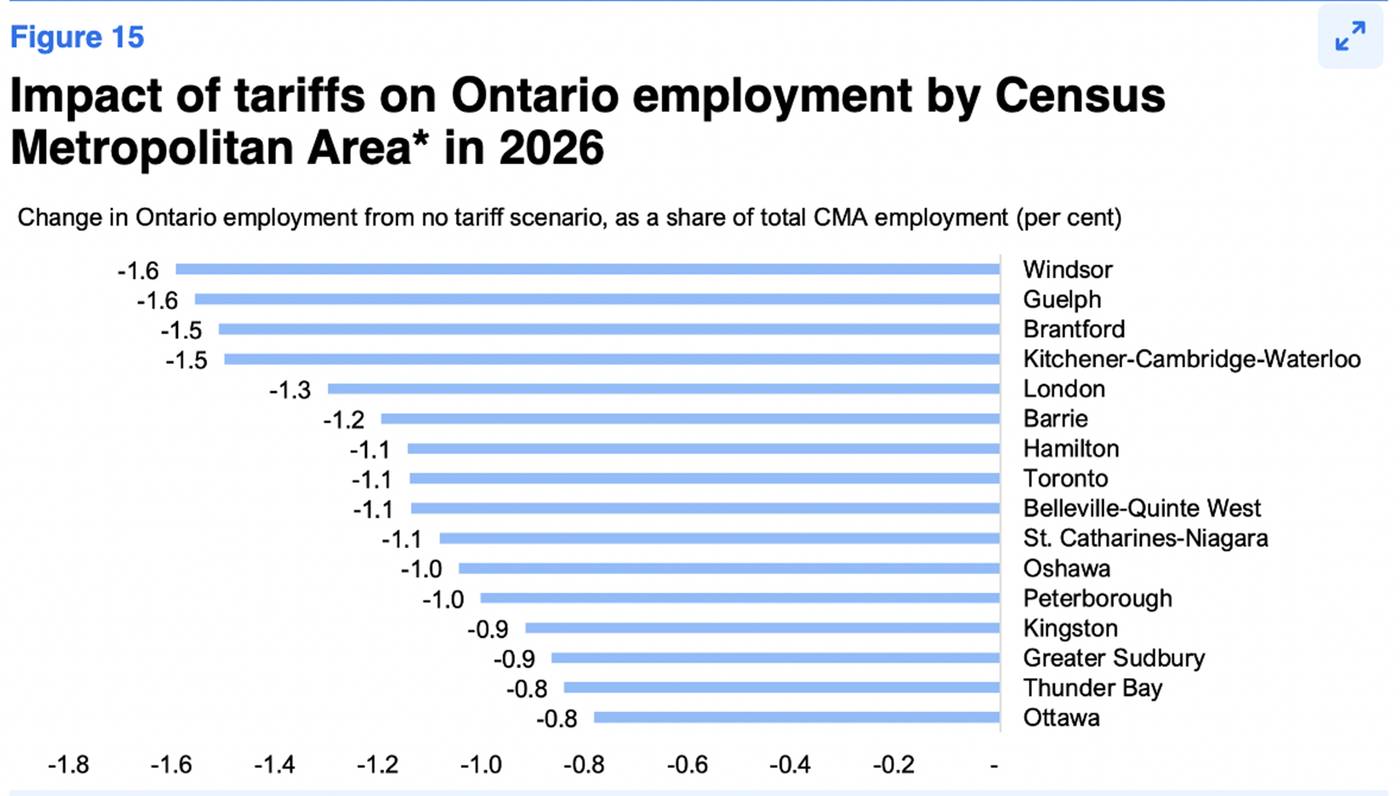

This will raise the province's overall unemployment rate by 1.1 per cent, pushing us to 7.7 per cent by 2029. Within Ontario's bounds, southwestern locales reliant on manufacturing exports, such as Windsor and Guelph, will be worse off than other regions.

At the same time, costs will also rise, anticipated to be 0.2 percentage points more than with no tariffs in 2025, and 0.3 percentage points more in 2026 thanks to heightening import prices "due to Canada’s tariff retaliation, higher U.S. inflation and a slightly weaker Canadian dollar."

Hopefully, though helming the same Liberal leadership that these poor economic conditions festered under, Canadian Prime Minister Mark Carney can take action to mitigate the tariff-related turmoil that's on the horizon.

The FAO offers more insights about what's to come in its report.

Stephen A. Waycott/Shutterstock.com

Latest Videos

Latest Videos

Join the conversation Load comments