Imbalance between supply and demand in Toronto's housing market hits all-time record

The widely-held dream of home ownership in Toronto has quickly become a nightmare for those who've managed to achieve it, as interest rates, a cost of living crisis and other factors have forced the city's once-booming housing market into a sharp downward spiral.

As thousands of new listings pour onto the market, sales have receded to ghastly lows, with well over triple the number of homes coming up for sale as people buying them each month.

In the residential construction world, stalled projects and receiverships abound, with builders and owners of condos especially finding it virtually impossible to garner any interest. Fewer condo units across the GTA have been changing hands than in the early '90s — a stark contrast to the days of quick sales and bidding wars just a few years ago.

And, the May 2025 update from the Toronto Regional Real Estate Board (TRREB), released Wednesday, shows that the devastation for realtors, developers, and everyday property owners looking to sell is far from over, and is worsening still.

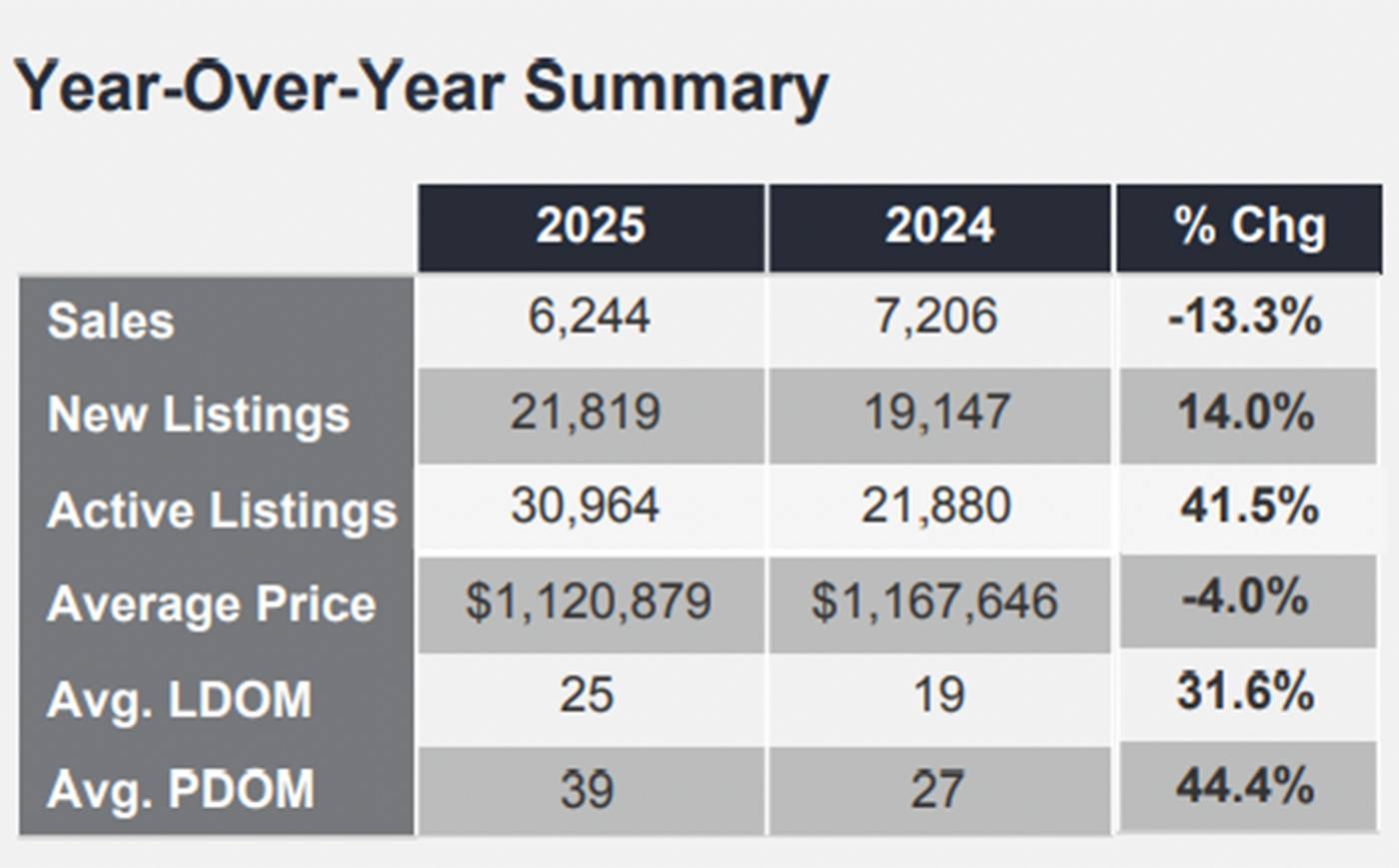

With 6,244 total home sales across the GTA (13.3 per cent fewer than in May of last year) and 21,819 new properties listed (14 per cent more than last year), last month was another doozy for those with a stake in the market.

The total number of active listings hit a staggering 30,964, marking a shocking 41.5 per cent increase from the same time in 2024 (though some months in recent memory have been even worse, with jumps of more than 70 per cent).

The average price of a home, meanwhile, has only edged down slightly, with an annual decrease of four per cent across all property types (from $1,167,646 in May 2024 to $1,120,879 in May 2025) — not enough to inspire more activity. This has led properties to sit on the market for nearly 50 per cent longer than what was normal for the city this time last year, which itself was significantly longer than what the industry is used to.

May 2025 real estate figures from TRREB's Market Watch report.

The condo segment continues to be hit the hardest, with sales declines of around 25 per cent from last spring's levels. But, sales figures are down across the board for all property types, save for semi-detached houses and townhomes in the 416 specifically (with year-over-year increases of 1.5 per cent and 3.4 per cent, respectively).

Together, all of this paints a picture of a continuing negative trend that has anyone with skin in the game understandably stressing. It also marks a new record for the largest disparity between supply and demand ever on record in the Toronto real estate market.

The GTA real estate market just saw the biggest gap between supply (new listings volume) & demand (sales volume) on record: pic.twitter.com/uVduzF79x9

— Daniel Foch (@daniel_foch) June 4, 2025

"Home ownership costs are more affordable this year compared to last. Average selling prices are lower, and so too are borrowing costs. All else being equal, sales should be up relative to 2024," the board's experts state.

They also try to remain positive, writing that "the issue is a lack of economic confidence. Once households are convinced that trade stability with the United States will be established and/or real options to mitigate our reliance on the United States exist, home sales will pick up."

ACHPF/Shutterstock.com

Latest Videos

Latest Videos

Join the conversation Load comments